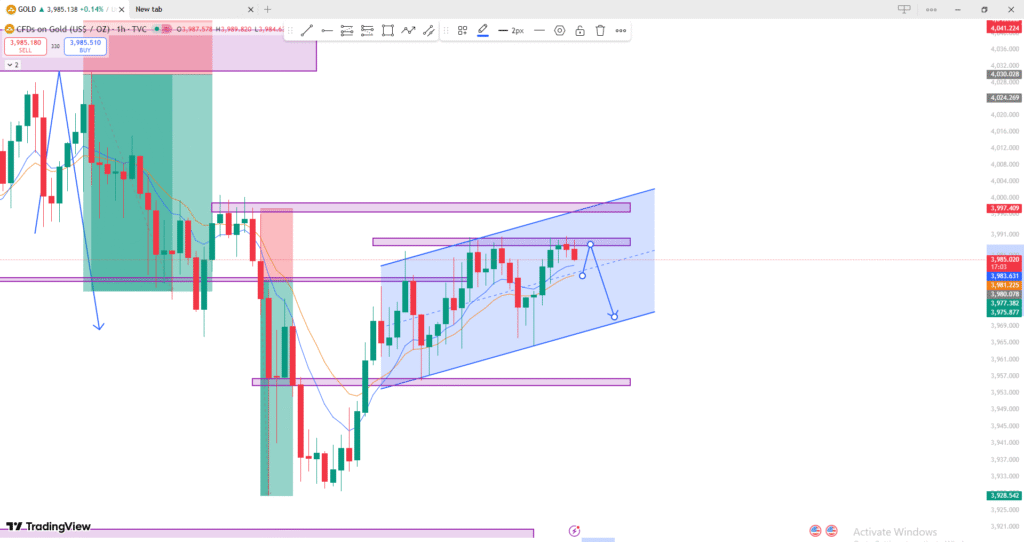

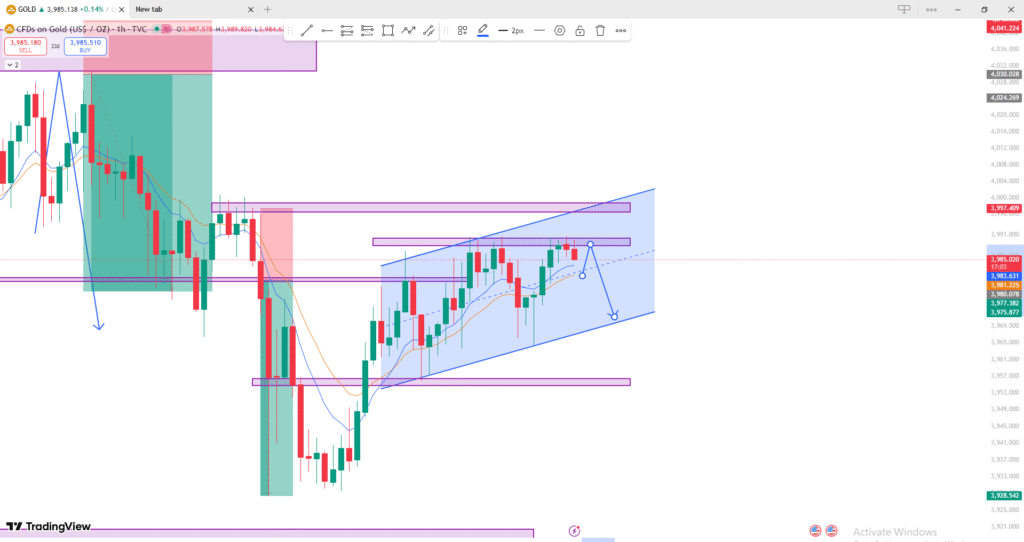

🔍 Technical Analysis (Gold 1H Chart)

- Ascending Channel (Blue Zone)

- Price is moving within an upward channel.

- The upper boundary is acting as resistance, and the lower boundary as support.

- Typically, price bounces between these lines until a clear breakout happens.

- Resistance Zone (Purple Area)

- Gold is currently trading near a resistance zone around 3985–3997.

- The last time price reached this area, it rejected and dropped down.

- A similar rejection could send the price lower toward the bottom of the channel.

- EMA Indicators (Orange & Blue Lines)

- The EMAs (possibly 9 and 21) show a short-term uptrend.

- However, since price is near resistance and the EMAs are flattening, a pullback is likely.

- If price falls below the EMAs, bearish momentum may increase.

- Possible Scenario (Blue Arrows)

- A rejection from the resistance zone could lead to a drop toward the channel support, around 3970–3950.

- If that support breaks, gold might fall deeper toward 3928–3920.

- Alternative Scenario

- If price closes strongly above 3997, that would signal a bullish breakout, and the next targets could be 4003–4020.

📊 Summary

| Aspect | Observation |

|---|---|

| Trend | Short-term bullish, but near resistance |

| Key Resistance | 3985–3997 |

| Key Support | 3970 / 3950 / 3928 |

| Likely Move | Small drop from resistance to lower channel |

| Confirmation | Bearish candle close below 3985 |

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA