📰 Recent Gold Market News

- The global price of gold continues to stay strong — for example, in Pakistan the international gold price rose to about US $4,007 per ounce, up by ~$37 recently. Pkrevenue.com+1

- The rally is largely being driven by a combination of safe-haven demand, central bank buying, and expectations around Federal Reserve (Fed) interest-rate policy. FX Leaders+2Sriwijaya News+2

- On the flip side, there are headwinds: strong U.S. economic data and a resilient dollar could dampen the upside for gold. Commodiloud+1

Key drivers to watch:

- Fed rate-cut expectations: lower rates favour gold because opportunity cost of holding non-yielding gold drops. The Economic Times

- Strength of the U.S. dollar: gold often moves inversely to the dollar. Discovery Alert+1

- Central bank purchases and geopolitical risk: both support the bullish case. Medium+1

📊 Chart & Technical Commentary

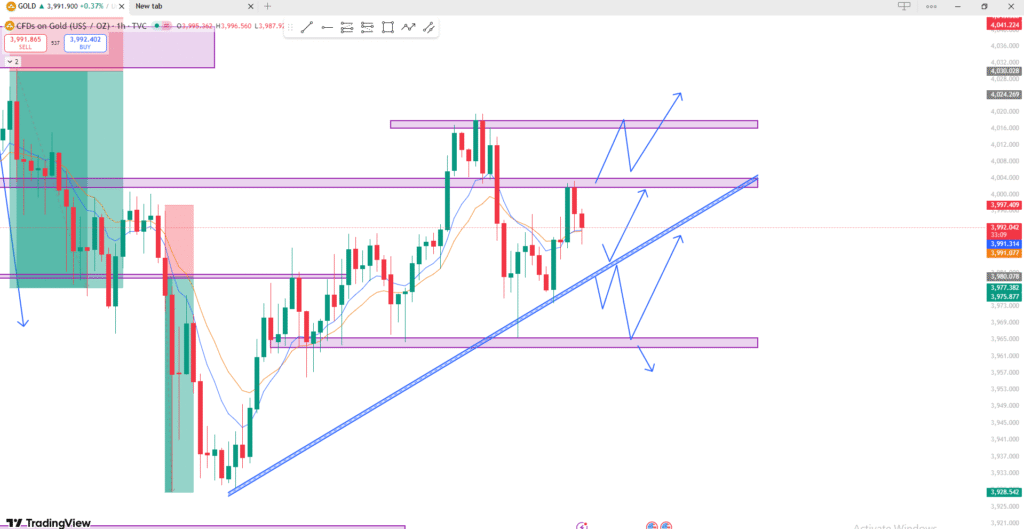

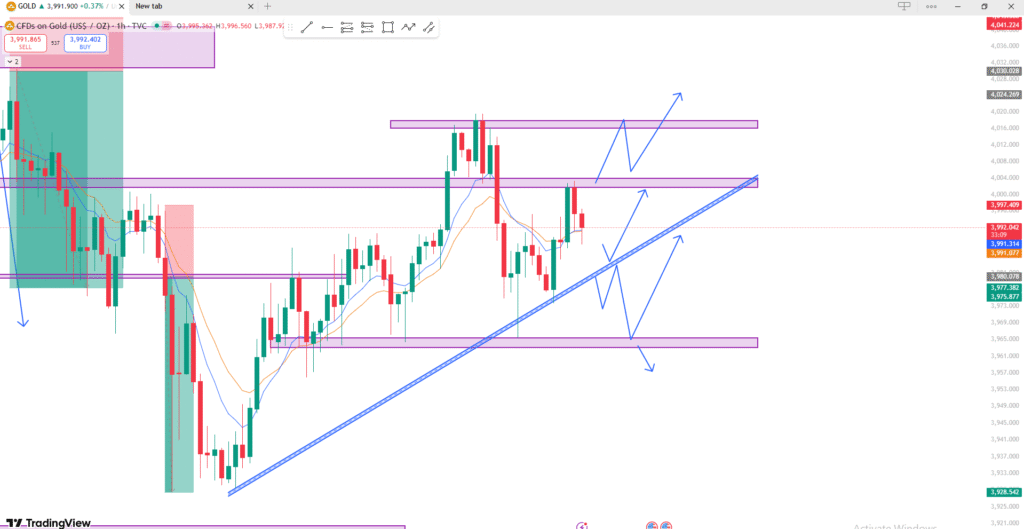

You posted a chart (looks like an hourly timeframe) showing:

- An upward sloping trend line (blue) supporting price.

- Several horizontal zones of support/resistance (purple boxes).

- Blue arrows indicating possible future paths: both upward breakout and downside breakdown options.

Here’s how I interpret it:

Bullish scenario

- If gold stays above the trend line support and the nearby horizontal support zone, then there’s a good chance it moves up into the next resistance zone.

- A clean breakout above the upper purple resistance could open further upside.

- This aligns with the bullish fundamentals: safe-haven demand, central bank buying, etc.

Bearish/Correction scenario

- If price breaks below the trend line and the support zone, then the downside becomes more likely.

- The breakout failure could coincide with a stronger dollar or hawkish Fed signals — both of which would hurt gold.

- The support below (another purple zone) becomes important for the downside target.

My bias & what I’d watch

- My bias leans bullish as long as the trend line holds and gold remains supported.

- But I’d exercise caution because the fundamentals (especially Fed & dollar) could turn the tide.

- Key levels to watch:

- Support: around the trend line + purple support zone.

- Resistance: upper purple zone (where arrows show potential breakout).

- If price breaks below support, then consider a shift toward the bear scenario.

✅ Summary for Today

- The fundamentals remain broadly supportive for gold, but some risk of correction exists (especially if dollar strengthens or Fed becomes hawkish).

- On the chart: holding above the trend line = bullish; losing that = potential for pull-back.

- If you trade gold: favour long positions when above support + trend line, and consider protective stops if the trend line is decisively broken.

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA