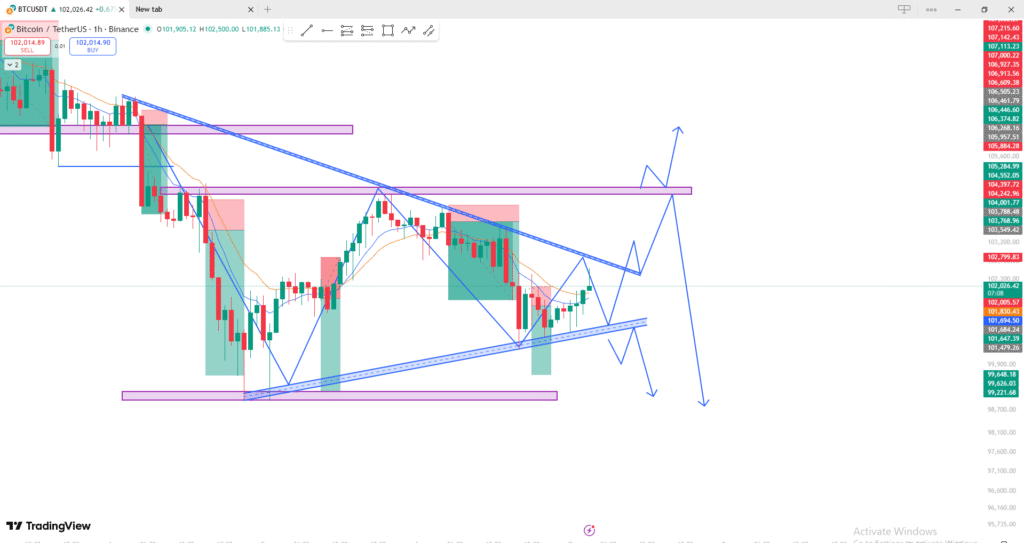

Here’s a technical analysis based on the chart you uploaded (BTC/USDT 1-hour timeframe):

🧭 Chart Overview

- The chart shows Bitcoin (BTC/USDT) trading around $102,000.

- A descending triangle or falling wedge pattern is visible, formed by:

- A downward resistance trendline (blue diagonal line on top)

- A rising support trendline (blue diagonal line below)

- There are purple horizontal zones indicating key support and resistance levels.

🔍 Key Technical Zones

- Resistance area: around $102,800 – $103,200 (marked with purple box)

- Support area: around $99,600 – $99,900

- Mid-range support: near $101,000

📈 Possible Scenarios

1. Bullish Scenario

If BTC breaks above the descending trendline:

- Expect a move toward $103,800 – $105,000 (next resistance zone).

- A successful retest of the breakout could confirm trend reversal.

- This aligns with the upper arrow projection in the chart.

Bullish confirmation:

→ Break and close above $103,200 with strong volume.

2. Bearish Scenario

If BTC fails to break the upper resistance and rejects from $102,800–$103,200:

- Price could drop back toward the rising support line (~$100,800–$101,000).

- A break below that line could push BTC down to the $99,600 zone or even lower.

Bearish confirmation:

→ Breakdown below $100,800 with heavy selling pressure.

⚖️ Summary

| Bias | Key Level | Next Target |

|---|---|---|

| Bullish | Break above $103,200 | $104,800 – $105,800 |

| Bearish | Drop below $100,800 | $99,800 – $98,800 |

🧠 Technical Insight

- The falling wedge structure often signals a potential bullish breakout.

- However, the resistance confluence near $103K–$103.5K is crucial — watch how price reacts there.

- Keep an eye on volume — low volume breakouts are often false moves.

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA