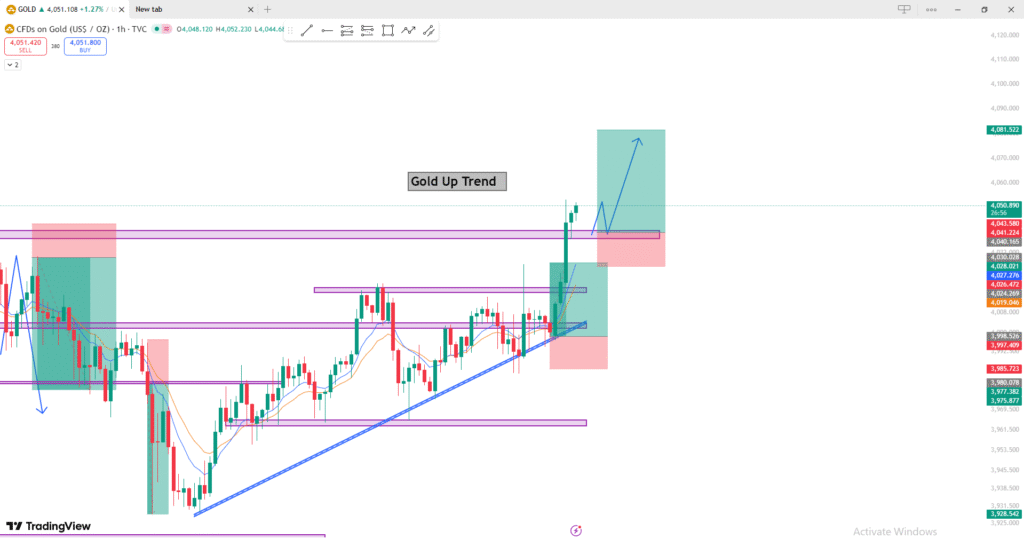

🟡 Chart Overview

- Timeframe: 1-hour (1H)

- Current Price: around $4,051/oz

- Trend Direction: Uptrend confirmed

- Chart Tools Used: Trendline, support/resistance zones, and risk–reward boxes

📈 Technical Analysis

1. Trend Structure

- The chart clearly shows a series of higher lows (ascending trendline in blue).

- Price recently broke above a strong horizontal resistance zone (purple line), confirming a bullish breakout.

- The breakout is accompanied by strong bullish candles, showing high momentum.

2. Support and Resistance

- Immediate Support (new): around $4,030 – $4,040 (previous resistance now turned support).

- Next Resistance (target zone): around $4,080 – $4,090 — marked by your upper green target box.

3. Moving Averages

- The short-term MAs (orange and blue lines) are both sloping upward, confirming bullish momentum.

- The faster MA has crossed above the slower one — another buy signal.

4. Price Action

- After the breakout, price is expected to pull back slightly to retest the broken resistance (now support), then continue upward — as your arrow projection suggests.

- This is a classic breakout–retest–continuation setup.

5. Risk–Reward Setup

- Your green box represents the take-profit zone; the red box shows the stop-loss zone.

- The ratio looks favorable (approx. 2:1 or better), meaning the potential reward outweighs the risk.

🧭 Summary

| Factor | Observation | Bias |

|---|---|---|

| Trend | Higher highs & higher lows | Bullish |

| Breakout | Above key resistance | Bullish |

| Support Zone | 4,030–4,040 | Buy area |

| Target Zone | 4,080–4,090 | Profit zone |

| Risk–Reward | Positive | Good |

🟢 Trading Idea (Example)

- Entry: On retest near $4,035–$4,045

- Stop Loss: Below $4,020

- Take Profit: Around $4,080–$4,090

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA