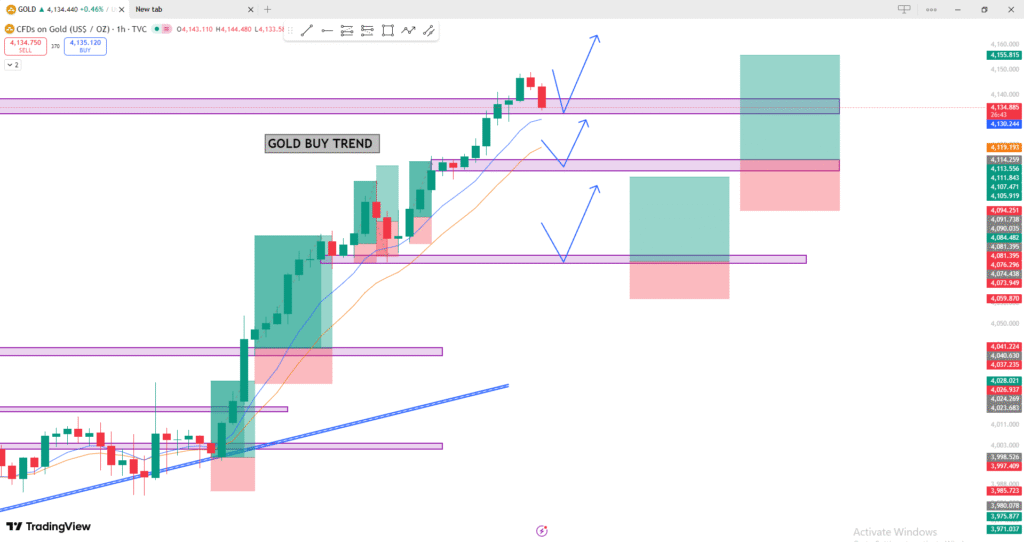

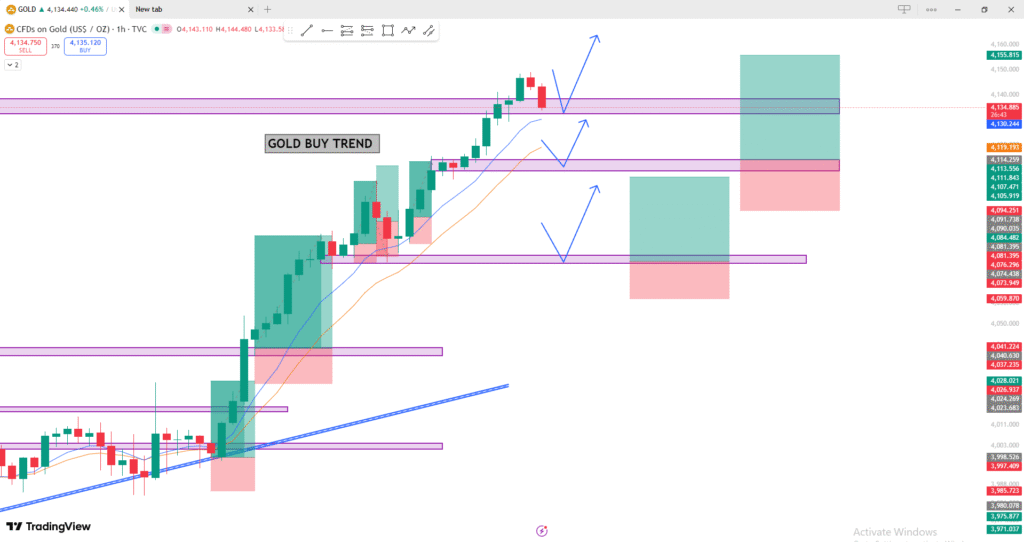

🔹 Current Overview

- Gold Price: Around $4,134/oz

- Trend: Clear bullish (buy) trend

- Moving Averages (EMAs):

- Both the short-term (blue) and medium-term (orange) EMAs are trending upward → confirming strong buying momentum.

- Recent candles show a small correction near the top — likely a pullback before continuation.

🔹 Key Support & Resistance Zones

| Type | Price Range (Approx.) | Description |

|---|---|---|

| 1st Support | 4,130 – 4,120 | Minor support zone; potential buy area |

| 2nd Support | 4,110 – 4,100 | EMA confluence + previous breakout zone |

| 3rd Support | 4,075 – 4,060 | Strong structural support; key defense zone for bulls |

| 1st Resistance | 4,155 – 4,160 | Immediate target zone; possible selling pressure |

| 2nd Target | 4,180+ | Extended bullish target if momentum continues |

🔹 Possible Scenarios & Trade Ideas

🟩 Scenario 1 (Most Likely): Trend Continuation

- Expect a pullback to 4,130–4,120, then a bounce upward.

- Entry: ~4,125 (buy)

- Stop-loss: below 4,105

- Target 1: 4,155

- Target 2: 4,180

➡️ Both EMAs and structure support a bullish continuation.

🟨 Scenario 2: Deeper Pullback Before Rebound

- If price dips to 4,100 or 4,075, look for bullish signals (reversal candles or volume spike).

- These areas align with EMA200 / structural support, making them solid buy zones.

🟥 Scenario 3: Bearish Reversal

- If gold closes below 4,060, the short-term uptrend may break.

- Next downside targets could be 4,040–4,020.

🔹 Summary

Gold remains in a strong buy trend with a healthy pullback in progress.

As long as price stays above 4,060, the market structure supports buy-the-dip strategies.

Look for bullish reactions from 4,120–4,100 to join the uptrend.

Good