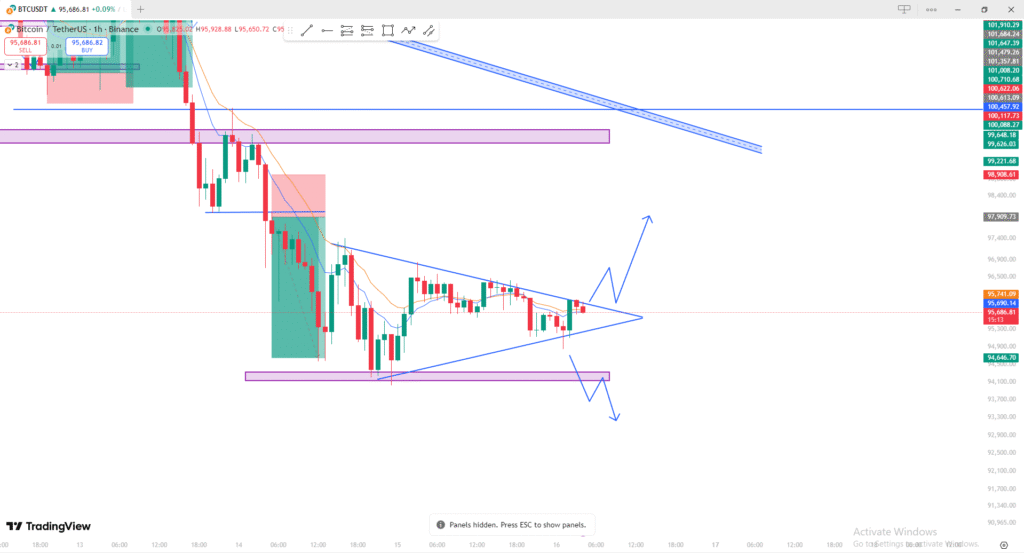

📊 Technical Analysis of BTC/USDT (1H Chart)

1. Symmetrical Triangle Formation

Price is currently consolidating inside a symmetrical triangle, which indicates a potential breakout soon. This pattern shows that buyers and sellers are balancing, and volatility is getting tighter.

- Upper trendline: Acting as resistance.

- Lower trendline: Acting as support.

A breakout from either side will likely give the next strong move.

2. Breakout Scenarios

🔵 Bullish Breakout

If price breaks above the upper triangle trendline, it suggests upward momentum.

Bullish targets:

- First resistance zone around $97,900 – $98,000

- Further upside possible toward the higher blue resistance zones near $100,000+

This move will be confirmed if:

- Candle closes above triangle resistance

- Volume increases on the breakout

🔴 Bearish Breakout

If price breaks below the lower triangle trendline, downside pressure increases.

Bearish targets:

- Immediate support zone highlighted (purple box)

- If that fails, further drop toward $94,000 – $93,500

This move will be confirmed if:

- Candle closes below triangle support

- Strong bearish volume appears

3. Trend Check

The overall larger trend shown earlier in the chart is downward, so:

- Bullish breakout may face resistance quickly.

- Bearish breakout aligns more with the broader market move.

However, triangles can break either direction—watch the close.

4. Summary

- Price is compressing inside a symmetrical triangle.

- Breakout direction will determine the next move.

- Above = bullish continuation.

Below = bearish continuation.

This is a neutral but tightening market structure—expect volatility soon.