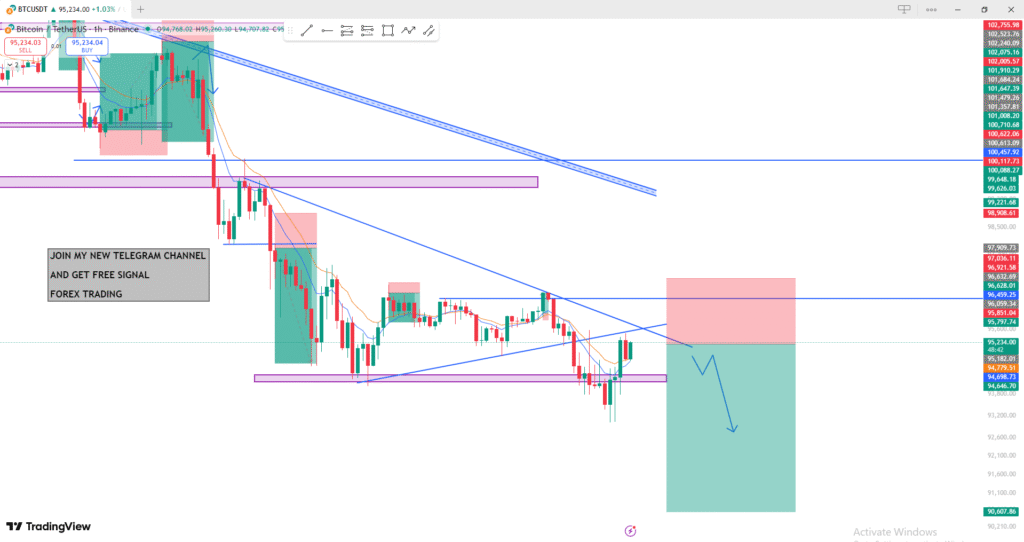

🔎 Chart Analysis (BTC/USDT – 1H Timeframe)

1. Trend Direction

The overall trend shown is bearish (downtrend).

You can see:

- Lower highs and lower lows forming.

- Several downward-sloping trendlines reinforcing bearish structure.

2. Key Zones

🔵 Resistance Zones

- A major resistance area is marked around 96,500 – 97,000 (blue zone).

- Price is currently approaching this zone from below.

- There is also a diagonal resistance (descending trendline) aligning with this zone.

These overlapping resistances increase the probability of a rejection.

🟣 Support Zones

- Important support sits around 94,500 – 95,000 (purple zone).

- Price recently bounced from this level.

3. Current Price Reaction

- Price is retesting a bearish trendline and a horizontal resistance at the same time.

- Candles show slowing bullish momentum as it approaches resistance.

- EMAs (short-term moving averages) are still pointing downward.

This suggests a potential sell setup.

4. Trade Idea Shown in the Chart

The chart illustrates a short (sell) position, likely based on:

- Retest of resistance.

- Trend continuation expectation.

The projected move (blue arrow) suggests:

- A drop back down toward 93,000 – 92,000.

Stop-loss is set above the resistance zone.

5. Conclusion

Bias: Bearish

As long as price stays below the resistance and trendline, downside continuation is likely.

Confirmation for sell:

- Bearish candle rejection at the resistance zone.

- Breakdown below local support inside the trendline area.

Invalidation:

- Strong breakout above 97,000 zone.

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA