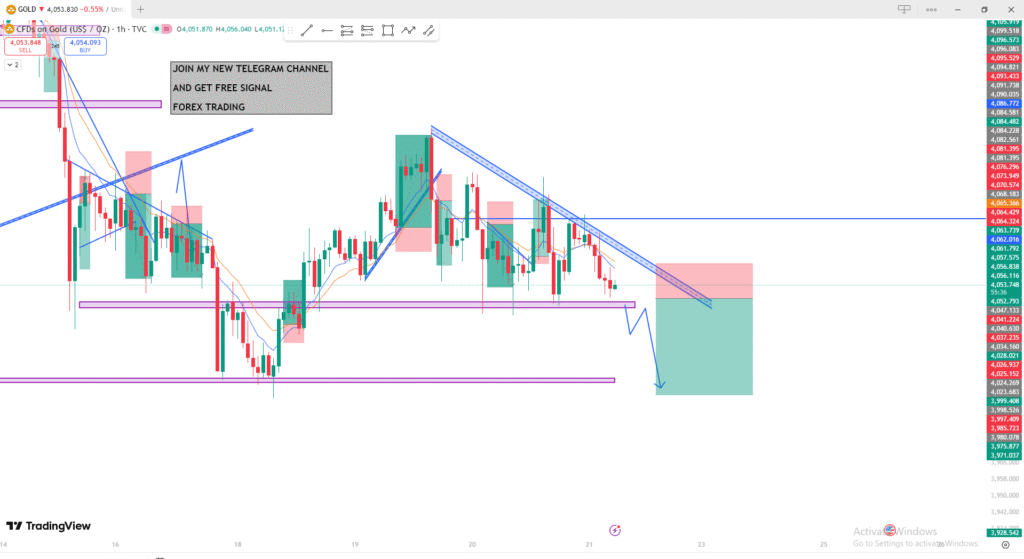

📊 Chart Analysis (XAU/USD – Gold, 1H Timeframe)

1. Trend Overview

- The chart shows a short-term downtrend, confirmed by:

- A descending trendline (multiple touches).

- Lower highs forming consistently.

- Price moving mainly below the moving averages.

2. Key Support & Resistance Zones

- Immediate support zone: The purple horizontal zone where price is currently resting.

This area has acted as support multiple times before. - Major support below: The deeper purple zone near the bottom of the chart, likely a strong demand area.

- Resistance: Blue horizontal line + the descending trendline above current price.

3. Market Structure

- The price is consolidating but leaning bearish.

- Multiple bearish candles near support indicate weakening buying pressure.

- The seller entries shown (red boxes) dominate the chart.

4. Expected Move (Based on Drawing)

The chart suggests:

- A slight pullback upward into the trendline (retest).

- A breakdown below support.

- A continuation downward toward the lower purple support zone.

This aligns with:

- Downtrend pattern

- Trendline rejection

- Weakening support

5. Trade Idea (According to the Chart)

Bias: Bearish

Possible Trade Setup:

- Sell after a small pullback into the trendline area.

- Stop-loss: Above the descending trendline / resistance zone (red area).

- Take-profit: Near the lower major support zone (green area).

Summary

Your chart indicates that Gold (XAU/USD) is maintaining a downtrend, and a breakdown from current support is likely. A bearish continuation move is expected after a pullback.

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA