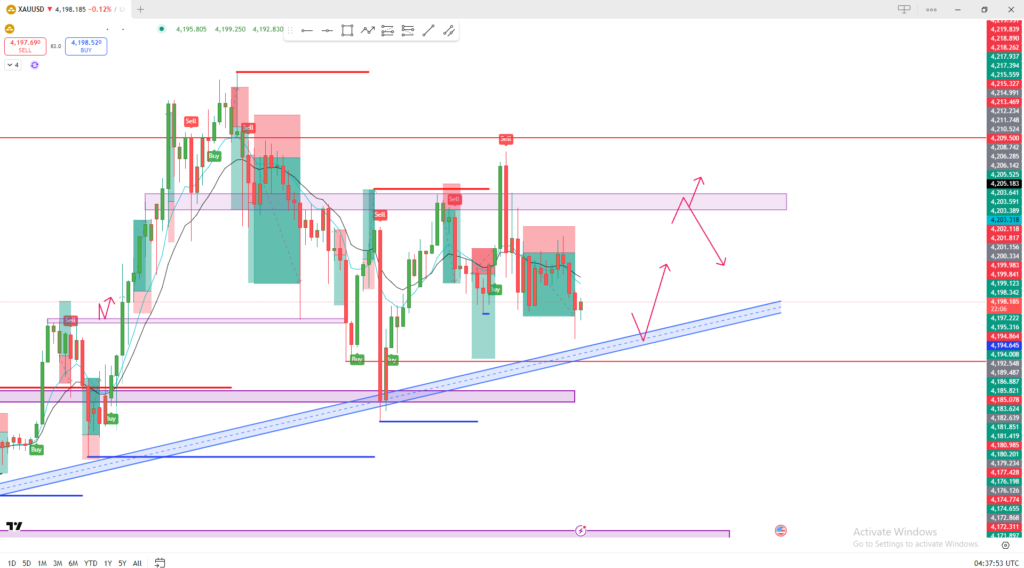

✅ Gold (XAUUSD) Technical Analysis

1. Trend Structure

- Price is currently pulling back toward a rising trendline (the blue trendline).

- The overall structure still looks bullish as long as the price stays above the trendline.

- Short-term candles show bearish momentum, but it’s corrective, not a strong downtrend.

2. Key Zones Marked on Your Chart

🔵 Trendline Support (Major Support)

- The blue ascending trendline is the first major support.

- If the price taps this level, it’s a potential buy area.

🟪 Supply Zone Above (Resistance)

- The purple zone above is a strong supply area.

- Price previously rejected from this zone multiple times.

3. Possible Scenarios (Based on Your Arrows)

📌 Scenario 1: Bounce from Trendline → Move Up

If gold touches the rising trendline:

- Expect a bullish reaction.

- It could move back toward:

- 4205 – 4210 (supply zone)

- If broken, next resistance is around 4230+

This scenario aligns with your upward arrows.

📌 Scenario 2: Break Below Trendline → Deeper Drop

If price breaks and closes below the trendline:

- This invalidates the bullish structure.

- Expect a drop toward the next support zone (purple zone beneath).

- Targets would be:

- 4185

- 4172–4165

This matches your downward arrows.

4. What to Look for Before Entering a Trade

For Buy:

- Bullish candlestick patterns at the trendline (hammer, engulfing).

- No candle close below the trendline.

For Sell:

- Clean break + retest of the trendline from below.

- Strong rejection from the supply zone around 4205–4210.

5. Summary

- The market is currently pulling back, not reversing.

- Trendline = key level to watch.

- Supply zone = potential sell area if price pushes up.

- Break of trendline = confirms deeper bearish movement.