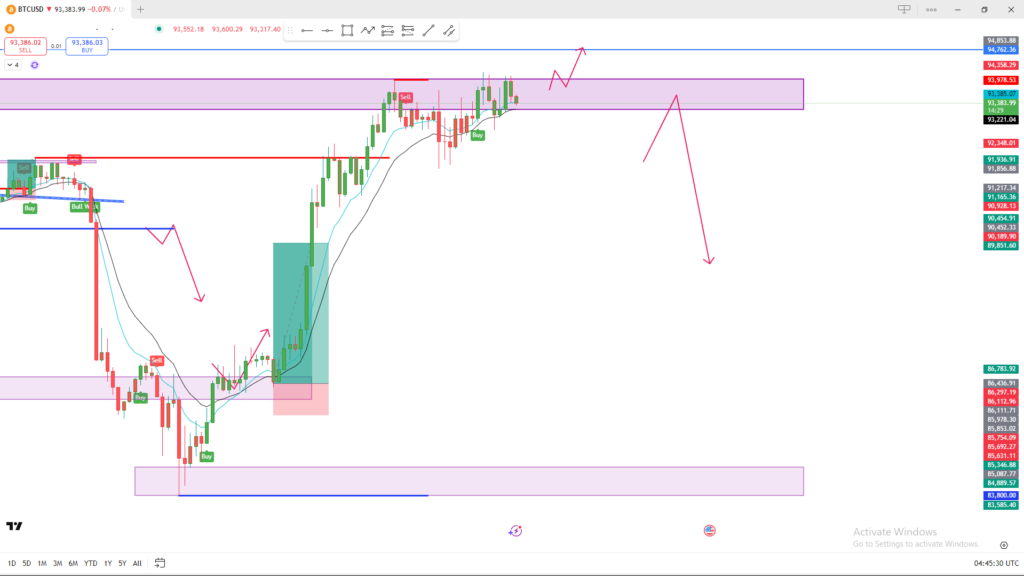

🔍 BTC/USD Technical Analysis

1. Price is currently consolidating inside a key supply zone

The purple zone you highlighted is a major resistance area, where price has reacted multiple times. Candles are showing indecision, meaning buyers are slowing down as they approach strong supply.

2. Two possible scenarios (as shown by your arrows)

🟩 Bullish Scenario

If BTC breaks above the upper boundary of the supply zone (around 93,700–94,300):

➡️ Upside Targets

- First target: 94,700 – 94,800

- Second target: 95,200+

This breakout would signal:

- Buyers regaining strength

- Continuation of the current uptrend

- Momentum supported by the moving averages trending upward

🟥 Bearish Scenario

If BTC fails to break above the supply zone and rejects strongly:

➡️ Expected Move

A downward move back into:

- 91,800 – 92,000 zone (first support)

- If broken, deeper drop to: 89,800 – 90,000 support

Your larger red arrow aligns with a potential larger correction if supply continues to overpower the buyers.

3. Trend Indicators

- Moving averages (EMA ribbon) are still sloping upward → trend still bullish

- But momentum is slowing near resistance → possible short-term pullback

4. Market Structure

- Higher highs & higher lows still intact

- But price is struggling to close above resistance → market indecision

📌 Summary

- Bullish bias overall, but BTC must break the supply zone to continue upward.

- Otherwise, expect a rejection and correction back toward 92K or even 90K.