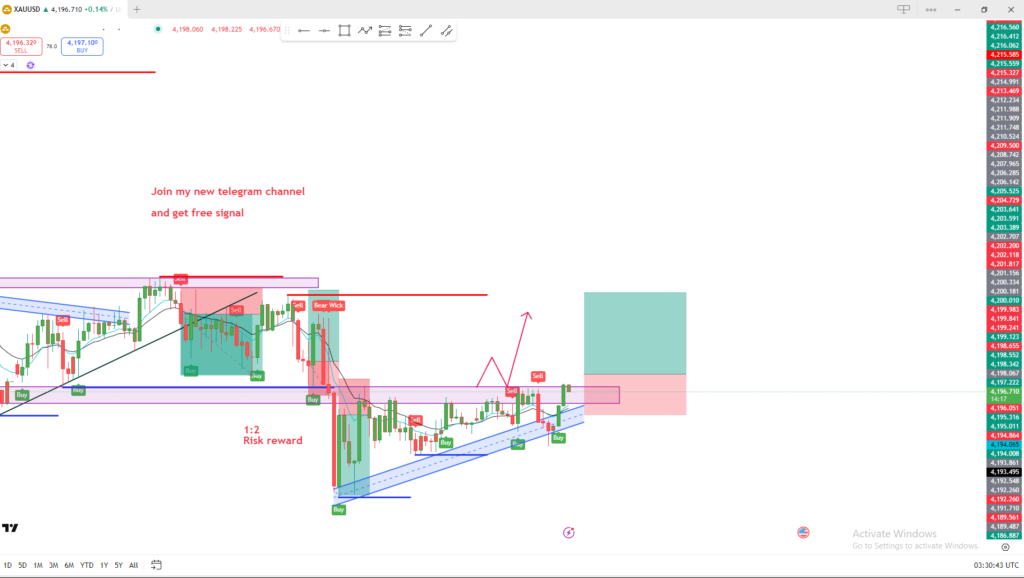

✅ Overall Market Structure

The chart shows XAU/USD (Gold) on a lower-timeframe setup with price moving inside a rising channel (ascending trendline). Buyers have been stepping in from the lower trendline, creating higher lows.

✅ Key Levels

1. Support Zone

- A strong support area is visible at the bottom where multiple Buy labels appear.

- Price respected this zone several times, forming an ascending support trendline.

2. Resistance Zone

- A purple horizontal zone above current price has acted as resistance.

- Several Sell labels and bearish reactions happened there.

- A previous bearish wick also formed at this level.

✅ Trend & Market Behavior

- The market is currently showing a short-term bullish structure (higher lows).

- Price is approaching the resistance zone again.

- There is a possible breakout setup toward the upside as shown by the red arrows in your markup.

✅ Risk-to-Reward Setup

You added a 1:2 risk-reward long setup:

- Stop-loss is placed below the structure near the trendline.

- Take-profit target is placed significantly higher above resistance.

- This suggests you expect price to break the resistance and continue upward.

✅ Important Notes

- Price is currently near a decision point (resistance).

- Two possible outcomes:

- Rejection → Sell (as previously shown by bearish reactions).

- Breakout → Buy continuation (as drawn with bullish projection arrows).

📌 Summary

Your chart indicates:

- Bullish short-term trend (ascending channel).

- Price approaching resistance.

- A planned long trade with 1:2 RR expecting a breakout.