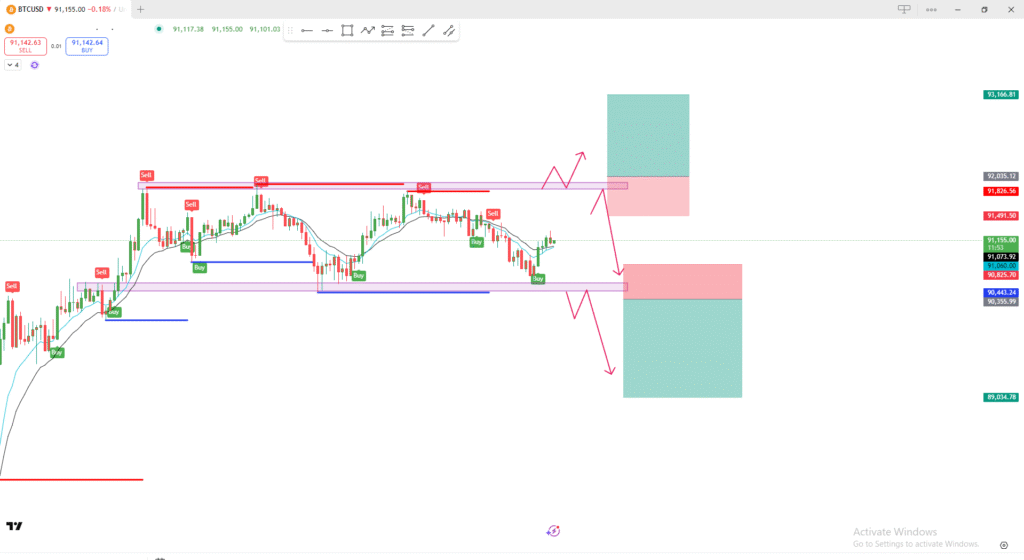

Chart Analysis (BTC/USD)

1. Price Structure

- The chart shows Bitcoin moving inside a horizontal range.

- Resistance zone (Top): Red area near the previous highs.

- Support zone (Bottom): Purple/blue area near the previous lows.

Price is currently in the middle of the range, not at an extreme.

2. Potential Scenarios (Shown by Pink Arrows)

🔼 Bullish Scenario

- Price moves upward toward the upper resistance zone.

- A false breakout / liquidity grab may happen above resistance.

- After that:

- Either price breaks above and continues higher (long setup area shown in green).

- Or it rejects and falls back into the range.

The large green box above is the long take-profit zone if a breakout occurs.

🔽 Bearish Scenario

- Price drops to the support zone at the bottom.

- A liquidity sweep may happen under support.

- After that:

- Price either breaks down, leading to the big downside target (large green box below).

- Or it rejects upward and returns into the range.

The red box below marks the sell zone / stop-loss area if the breakdown fails.

3. Indicators

- The chart includes Buy/Sell signals from an indicator.

- Price is hovering around the moving averages, meaning no strong trend yet—this confirms range conditions.

4. Summary

- Bitcoin is consolidating inside a clear range.

- Key zones:

- Resistance: where a breakout or rejection could happen.

- Support: where a breakdown or bounce could occur.

- You are planning two possible trades:

- Breakout long above resistance.

- Breakdown short below support.

Right now, the market is neutral and waiting for direction.