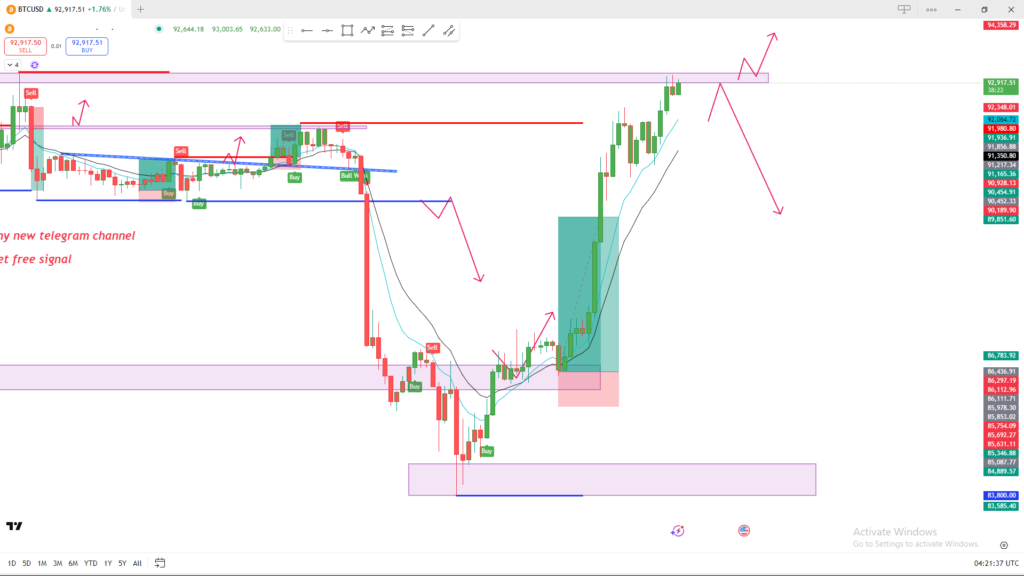

📊 Market Structure Analysis

1. Price Trend

- The market has recently made a strong bullish move upward, shown by the large green candles and the breakout above previous consolidation.

- EMAs (blue + black lines) are sloping upward, confirming short-term bullish momentum.

🔵 Key Zones (Support & Resistance)

1. Major Resistance Zone

- Price is currently inside a strong resistance zone (highlighted in purple at the top).

- This level previously caused multiple rejections.

- The red arrows indicate two possible reactions:

- Bullish scenario: Break and retest → continuation upward.

- Bearish scenario: Rejection → downward move back to lower support.

2. Mid-range Support Zone

- The purple zone in the middle acted as a demand area, creating the rise you see now.

- Strong bullish engulfing candles formed here → buyers are active.

3. Lower Support Zone

- The large purple box at the bottom shows a major demand zone where price previously reversed sharply.

📈 Bullish Scenario (If price breaks above resistance)

If candles close above the top purple zone:

- Expect a pullback to retest the broken resistance.

- If the retest holds → trend continuation upward.

- Your arrow drawing shows this correctly.

📉 Bearish Scenario (If price gets rejected)

If price fails to break above:

- Expect a decline back to:

- First support: mid purple zone

- If broken → deeper correction toward the lower demand zone

The downward arrows on the chart reflect this scenario.

📝 Summary

- Market bias right now: Bullish, but approaching strong resistance.

- Two critical reactions to watch:

- Breakout = continuation up

- Rejection = drop to support

This is a classic liquidity + supply/demand setup.