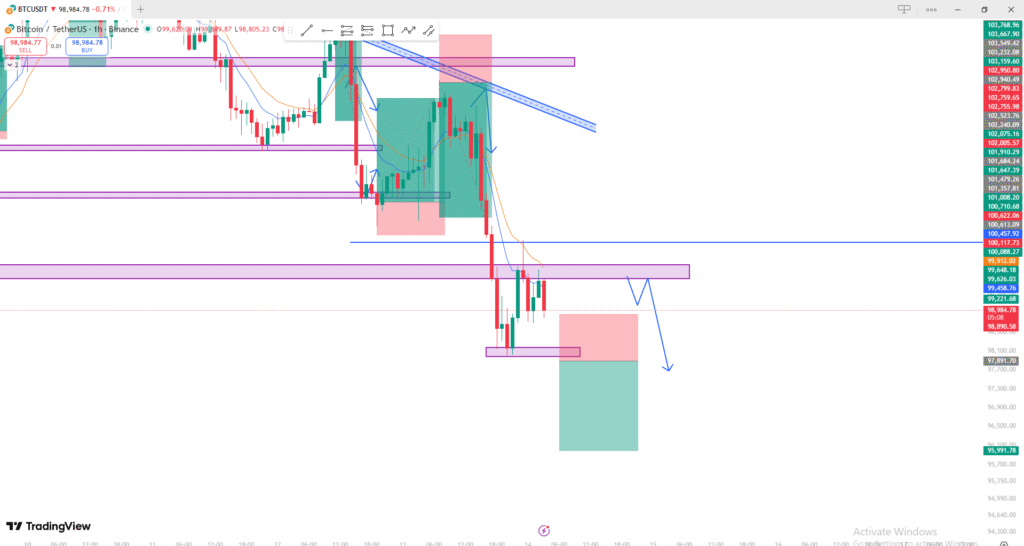

🔎 Chart Analysis (BTC/USDT – 1H)

1. Market Structure

- The chart shows a clear downtrend: lower highs and lower lows.

- A descending trendline (blue) confirms bearish momentum.

- Price recently made a strong impulsive drop, followed by a small consolidation.

2. Key Zones

🔵 Major Resistance Zone

- The purple zone above current price is acting as strong supply/resistance.

- Price is currently retesting this zone after the drop.

- Candles show rejection wicks → indicating sellers still active.

🟣 Support Zone

- A small purple zone under the current price shows prior demand, but it has already been broken once.

3. Price Action

- After breaking the support, price is performing a pullback into the resistance zone.

- The structure looks like a bearish continuation pattern.

- The small consolidation under the resistance suggests build-up for another move down.

4. Expected Move (Based on Your Drawing)

Your arrows show:

- A push into the purple resistance.

- Rejection.

- Continuation downward into the lower green target zone.

This aligns with the current bearish trend.

5. Indicators

- EMAs (orange and blue) are:

- Sloping downward.

- Acting as dynamic resistance.

- Price is below both EMAs → bearish confirmation.

6. Overall Bias

Bearish, unless price breaks and closes above the purple resistance zone.

📉 Summary

- Trend = Downtrend

- Price = Retesting resistance

- Bias = Continuation to the downside

- Entry idea = Look for rejection at resistance

- Invalidated if = Candles close above the purple zone + EMAs flip upward

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA