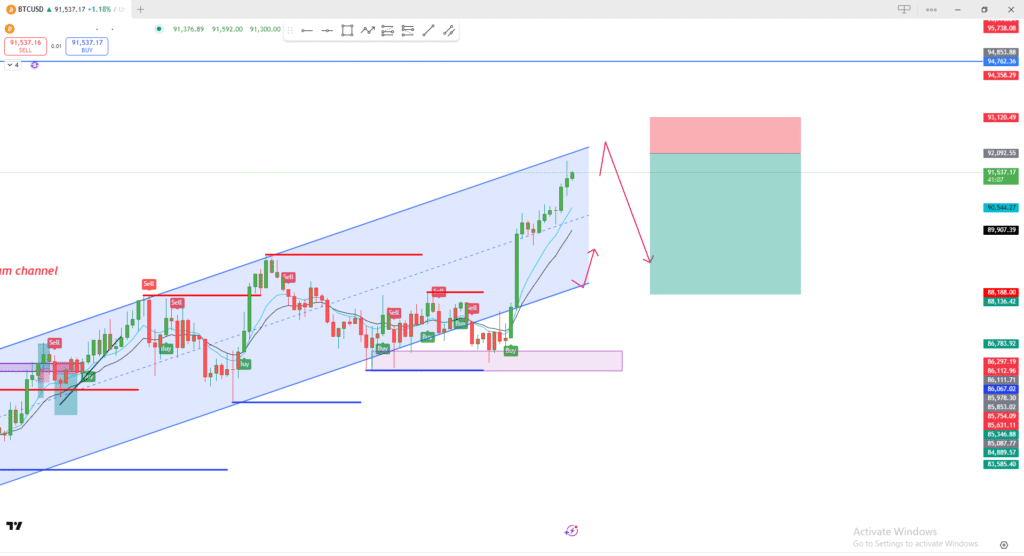

✅ Overall Market Structure

- The chart shows BTC moving inside an ascending (bullish) channel.

- Price is currently near the top of the channel, which is typically a zone of potential resistance where price may pull back.

- The lower boundary of the channel has been respected multiple times, confirming the trend.

✅ Recent Price Action

- A strong bullish push took price from the lower channel boundary straight toward the upper boundary.

- The candles near the top look extended, suggesting momentum is high but possibly overextended.

- The chart includes a projected reversal zone, indicating your expectation of a pullback.

✅ Possible Scenarios (Based on the Drawing)

1️⃣ Short-Term Rejection (Likely)

- Because price is at the upper trendline, it may:

- Reject downward,

- Retest the midline or lower boundary of the channel.

This matches the red downward arrows drawn.

2️⃣ Retracement to Support

- Your arrows show price possibly dropping to:

- The mid-channel dashed line, or

- The lower trendline (strong support).

The lower trendline is a strong buy zone if the channel remains valid.

3️⃣ Breakout Scenario (Less likely but possible)

- If the bullish momentum continues, BTC could break above the channel.

- But the large red area (resistance zone) suggests you expect price to struggle there.

✅ Indicators Used

Although the indicators are not fully visible, I can see:

- Moving Averages (MA ribbon) — showing upward slope → bullish trend.

- Buy/Sell signals (probably from an algo indicator) marking repeated reactions near levels.

✅ Risk/Reward Box

- The green box = target area for a long setup.

- The red box = stop-loss zone.

- This suggests you are planning a short-term correction, then another upward move.

🎯 Summary

- BTC is currently at a resistance zone near the top of an ascending channel.

- A pullback is likely, as shown in your arrows.

- Key support levels are:

- Mid-channel

- Lower channel line

- Trend remains bullish as long as BTC stays inside the channel.