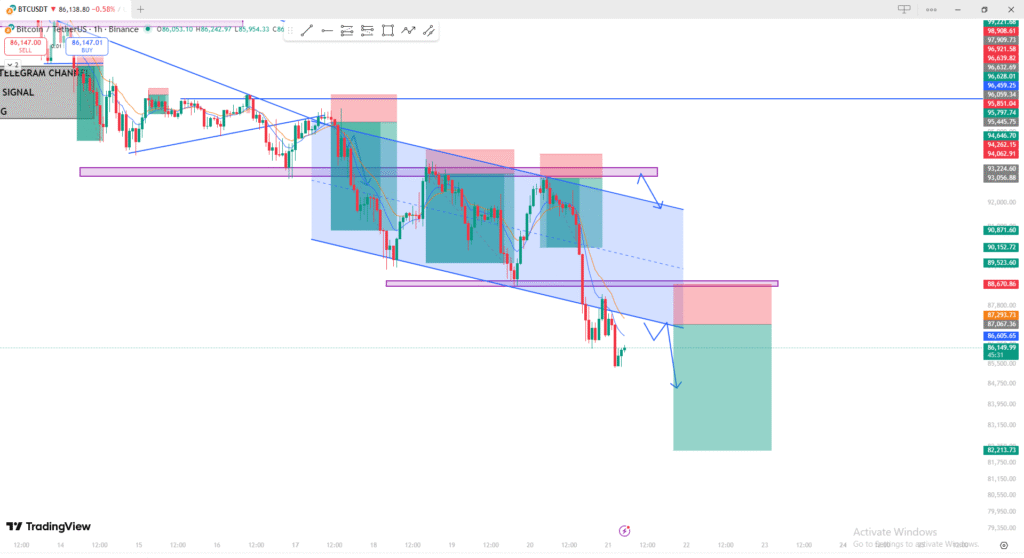

✅ BTC/USDT Chart Analysis (1H Timeframe)

1. Overall Trend → Bearish

The chart clearly shows a descending channel, meaning:

- Price is forming lower highs and lower lows

- Every time price reaches the upper channel trendline, it gets rejected

- Momentum is consistently bearish

This confirms a strong downtrend structure.

2. Key Levels (Purple Zones)

The purple horizontal zones represent important support/resistance flips:

- Previous support → now acting as resistance

- Every pullback into these zones shows strong selling pressure

- The latest retest also failed, sending price downward again

These zones are ideal for sell setups.

3. Sell Setup Shown in Chart

Your chart displays a classic trend-continuation sell:

Entry Logic

- Small pullback into purple resistance zone

- Confluence with descending channel upper boundary

- Price also reacting to EMA (bearish slope)

👉 Entry = Sell on retest of resistance

Stop Loss

- Placed slightly above the resistance zone (red box)

Take Profit

- Channel lower trendline

- Extended target into the deeper liquidity zone (large green box)

This is a clean R:R setup.

4. Market Psychology

This pattern reflects:

- Weak buyers → smaller pullbacks

- Strong sellers → strong downward impulses

- EMA is sloping downward → momentum remains bearish

Everything aligns with continuation to the downside.

5. Expected Move (Based on Your Drawing)

According to the arrows in your chart:

- A small bullish pullback

- Rejection at resistance

- A sharper drop toward the 82k region (target zone)

This is a textbook trend continuation pattern.

📉 Summary

| Factor | Reading |

|---|---|

| Trend | Bearish |

| Structure | Descending Channel |

| Pullback | Weak |

| Momentum | Bearish |

| Best Setup | Sell pullbacks |

| Target | Lower channel / 82k zone |