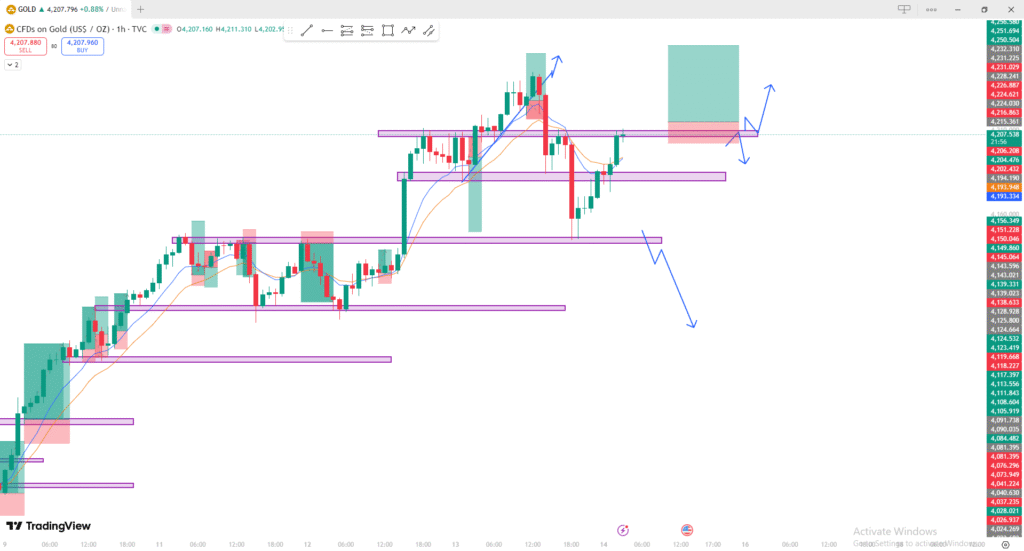

📊 Market Structure Analysis (GOLD – 1H Chart)

1. Overall Trend

- The market is currently in a bullish structure, making higher highs and higher lows.

- Price recently made a strong impulsive move upward, followed by a pullback into a previous support zone.

2. Key Zones Marked on Your Chart

🟪 Major Support Zones

- Lower purple zone: This is a strong demand area where price previously rejected and pushed upward.

- Price bounced here again, showing buyers still active.

🟪 Mid-level Support Zone

- Price recently pulled back into this zone, found buyers, and started moving up again.

🟥🟩 Supply Zone (upper pink box)

- This is the key decision point.

- Price is currently retesting this supply area.

- Market will either break above and continue bullish OR reject and move down.

3. Possible Scenarios (Based on Your Arrows)

📈 Bullish Scenario

- If price breaks above the top supply zone and closes strongly:

- Expect continuation to the upside.

- The long green box on your chart is a potential long target zone.

- Valid as long as price stays above the mid-level support.

📉 Bearish Scenario

- If price rejects the supply zone:

- Expect a move back down toward the mid support zone.

- A deeper rejection could target the lower major support zone (your far-right downward arrow).

4. Indicators

- The moving averages (blue and orange) are crossed bullish currently.

- Price is trading above both MAs, signaling short-term bullish momentum.

5. Summary

- Trend: Bullish

- Current position: Price retesting supply

- Decision point: Break → Buy continuation / Reject → Sell retracement

- Both bullish and bearish arrows you drew are valid depending on reaction at the supply zone.

JOIN EXNESS BROKER 3/7 MINUTES VERIFY ACCOUNT

WITHDRAWAL IN FEW MINUTES

Exness:

https://one.exnessonelink.com/a/j295642k3f

XM :

https://www.xm.com/referral?token=VMcR3Zp27768XbCPjr9nGA