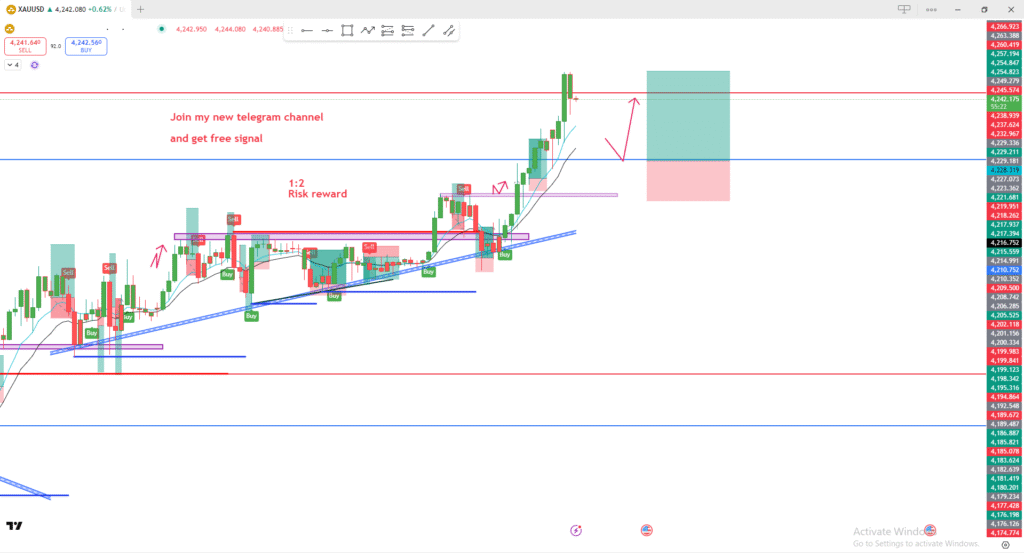

📊 XAUUSD (Gold) – Technical Analysis

1. Overall Market Structure

The chart shows a strong uptrend, confirmed by:

- Higher highs and higher lows

- Price respecting the ascending trendline (blue)

- Multiple bullish candles with momentum

This indicates buyers are in control.

2. Key Zones Identified

🔵 Major Support Zone

Around 4,229 – 4,231, marked by the thick blue horizontal line.

This zone acted as resistance before and has now become support.

🔴 Resistance / Take-Profit Zone

The upper red line shows the resistance area where price has currently reacted.

3. Recent Price Action

- Price made a strong bullish breakout above previous consolidation.

- After breaking out, it pulled back slightly from the top (small bearish candle).

- This suggests a possible retracement before continuation.

4. Expected Move (Based on Your Drawing)

You illustrated a potential scenario:

🔻 Short-term Bearish Retracement

Price may drop to retest:

- The previous breakout zone

- The ascending trendline

- The support area

This would be a healthy correction.

🔺 Bullish Continuation

After retest, price may:

- Bounce and continue upward

- Continue the main trend

This aligns with a trend-following buy setup.

5. Risk–Reward

You marked a trade with a 1:2 RR ratio, which is good risk management:

- Small stop loss below support

- Larger take-profit target

6. Buy Opportunity

A potential buy area is around:

- Retest of support zone

- Trendline touch

- Bullish confirmation candle

This would be a high-probability entry in an uptrend.

Summary

✔ Market is in a strong uptrend

✔ Price may retrace to support

✔ Good buy opportunity on retest

✔ Resistance shown at the top

✔ 1:2 RR trade setup is valid