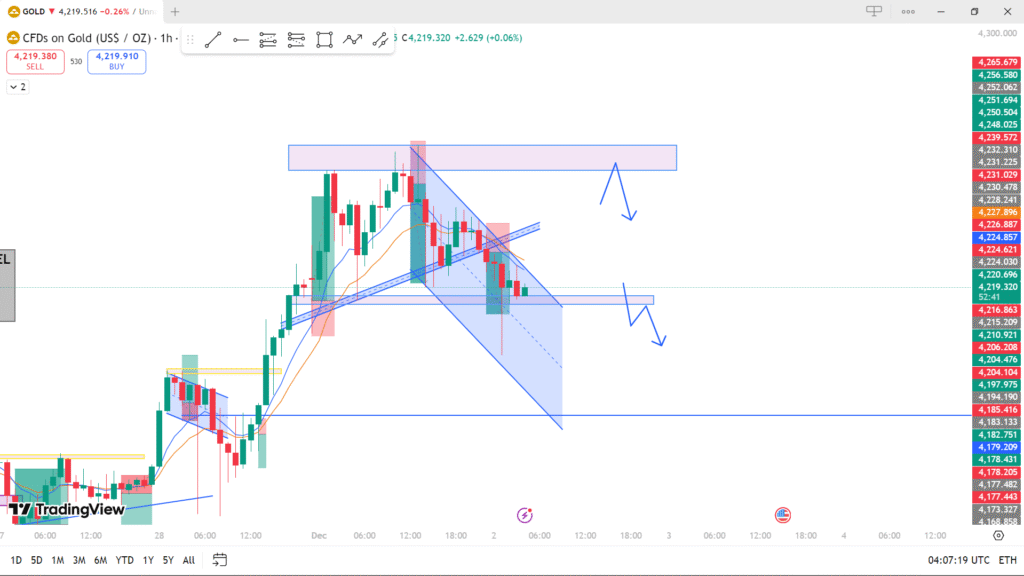

📌 Technical Analysis of the Gold (XAUUSD) Chart

1. Market Structure

- The price previously made a strong bullish move, but it is now forming a descending channel, indicating short-term bearish pressure.

- Multiple rejections from the upper supply zone (highlighted in purple) confirm strong resistance around that level.

2. Key Zones

🔵 Supply Zone (Resistance)

- Price attempted to break above the supply zone several times but failed.

- This suggests smart money selling pressure and a potential reversal area.

🔵 Demand Zone (Support)

- You marked a small support area below current price.

- If the price breaks this level, a further drop is likely.

3. Trendlines and Patterns

- The previous ascending trendline has been broken, confirming a shift in structure.

- Price is now respecting a bearish descending channel, meaning sellers are controlling the market.

4. Possible Scenarios (based on your arrows)

🔽 Scenario 1: Bearish Continuation (Most Likely)

- If price retests the broken support / trendline and gets rejected:

- Expect a continuation down toward the lower blue zone.

- Structure supports this because:

- Lower highs

- Bearish channel

- Supply zone rejection

🔼 Scenario 2: Bullish Pullback

- If price breaks above the descending channel and retests:

- Only then we may see a move back up toward the upper supply zone.

- But this requires a strong bullish breakout, which is not visible yet.

5. Summary

✔ Market is currently bearish

✔ Price is moving inside a downward channel

✔ Expect a drop if support breaks

✔ Resistance zone above remains strong

✔ Wait for a clear breakout before considering buys