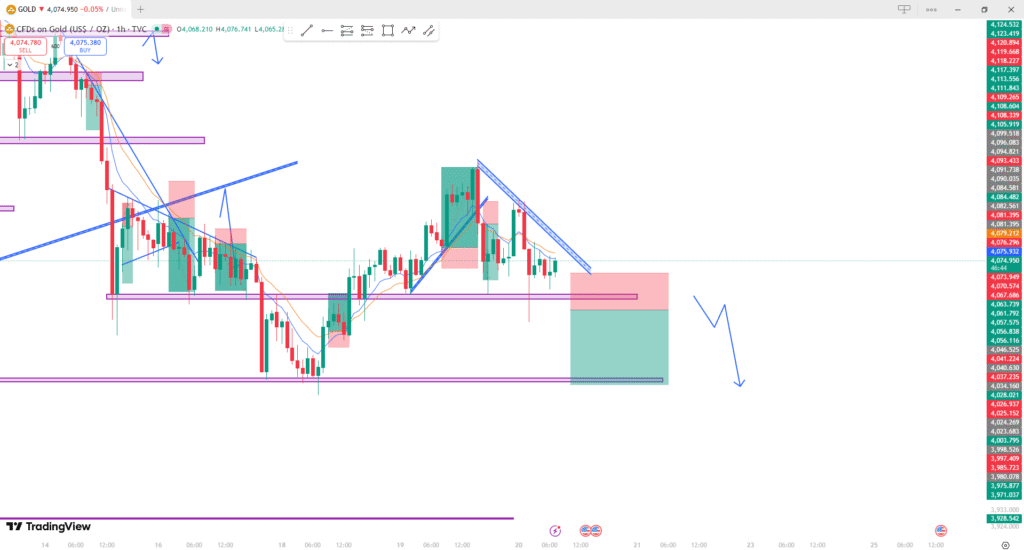

🔍 Overall Market Context

The chart shows GOLD (XAUUSD) on the 1-hour timeframe, and the structure appears to be in a downtrend. The market has been forming lower highs and lower lows, respecting a descending trendline.

🔹 Key Observations

1. Descending Trendline (Bearish Structure)

- You have drawn a downward sloping trendline connecting recent highs.

- Price is still respecting this trendline, showing sellers remain in control.

2. Support Zone Retest

- Price is hovering around a horizontal support zone (marked in pink).

- Multiple candles are failing to close strongly above the zone → weak bullish pressure.

3. Recent Pullback Looks Corrective

- The upward moves are small and corrective, while downward legs are impulsive → typical bearish momentum.

4. Bearish Breakout Setup

- You marked an entry below support, with a large risk-reward toward the next major support below.

- The idea:

✔ Break and close below the pink zone

✔ Retest

✔ Continue down to the lower purple support line

Your arrow suggests you’re expecting the breakdown to continue.

🔻 Bearish Confirmation Signals

These signals support your short idea:

- Price failing to break above moving averages (orange and blue lines).

- Lower highs forming at the trendline.

- Support zone getting weaker with repeated tests.

- A long downside wick already penetrated the zone → early liquidity grab before the real drop.

📉 Expected Move

If price breaks and closes below the support zone:

➡️ Expect a drop toward the next major support (bottom purple line).

➡️ This aligns with your marked short trade idea.

📌 What to Watch Next

- A strong bearish candle breaking support.

- No immediate strong bullish engulfing near the zone.

- Retest of the broken support turning into resistance.