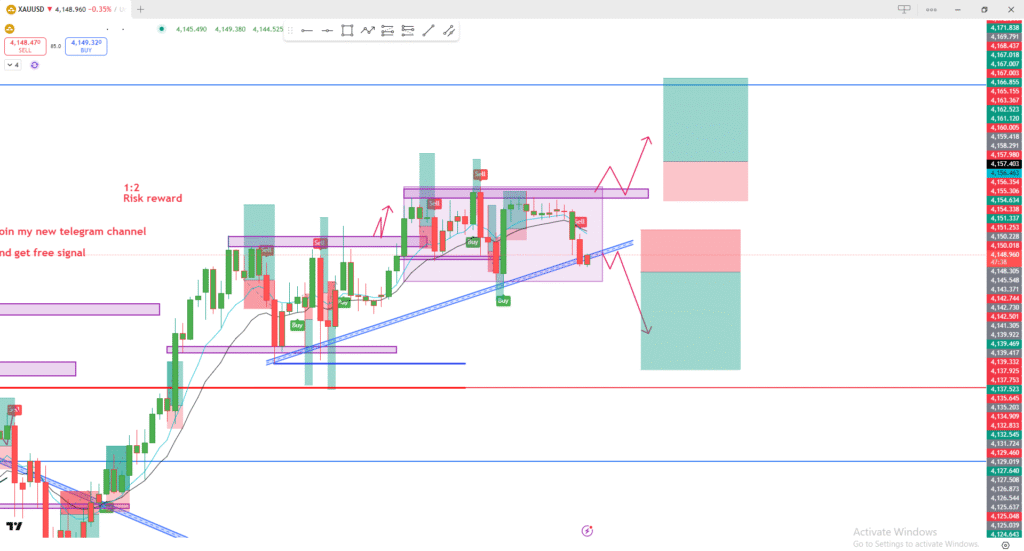

📊 Market Structure Overview (XAU/USD)

Your chart shows Gold (XAUUSD) on what appears to be a short-term timeframe (likely M15 or M30). Price is currently sitting on a rising trendline but showing weakness.

🔍 Key Observations

1. Price Inside a Consolidation Zone

- The purple rectangular box shows a supply/resistance zone where multiple sell signals appeared.

- Price keeps rejecting this zone, indicating strong sellers above.

2. Trendline Weakness

- Price is currently breaking below the blue rising trendline.

- Candles show bearish pressure with smaller bullish corrections.

This suggests the trendline is losing strength.

3. Two Possible Scenarios (as You Drew)

📉 Scenario 1: Bearish Breakdown (More Likely)

If the price:

- Breaks the trendline cleanly

- Retests it as resistance

Then a downward move is expected.

Your marked red zone shows a sell entry, targeting the large green zone below.

Reason:

- Multiple rejections from supply

- Bearish structure forming

- Trendline failure

📈 Scenario 2: Bullish Rebound (Less Likely but Possible)

Price may:

- Bounce from the lower boundary of the purple zone

- Reclaim the trendline

- Break the consolidation resistance

Then it can continue upward toward the large green target zone at the top.

This requires a strong bullish candle close above resistance.

🎯 Risk-to-Reward (1:2)

Your RR ratio is correct.

Both setups (buy and sell) have approx. 1:2 RR, which is good risk management.

📌 Summary

Market is currently in a decision zone.

Bearish setup is stronger at the moment due to trendline weakness and repeated rejections.

Bullish setup only valid if price breaks and closes above the purple resistance zone.