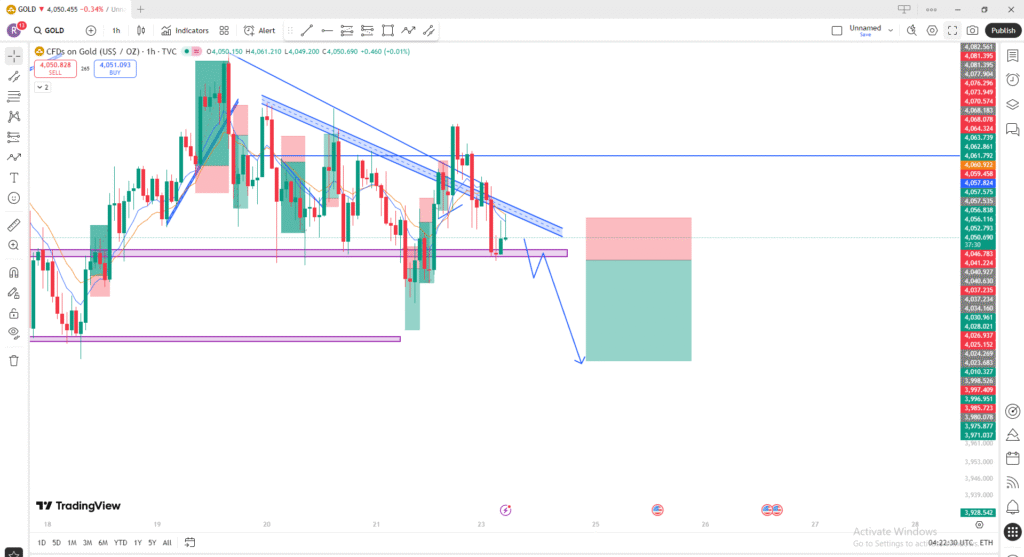

The chart is Gold (XAU/USD) on the 1-hour timeframe.

You’ve drawn several key elements:

- Descending trendlines (showing short-term bearish structure)

- Support zones (highlighted in purple)

- A projected bearish move (blue arrow)

- A sell setup with Stop Loss (red box) and Take Profit (green box)

Price Structure Analysis

1. Bearish Market Structure

- Price is forming lower highs and lower lows.

- Multiple descending trendlines confirm sellers are in control.

- Recent candles continue to reject the trendline, strengthening the bearish bias.

2. Key Support Zone

- There is a major horizontal support (purple zone) around 4050 – 4046.

- Price is currently sitting on this support.

- Many wick rejections suggest this level is important.

3. Break of Support Expected

Your blue projection shows:

- Price may retest the broken support from below.

- Then continue downwards following the bearish trend.

This aligns with typical price action:

- Break → Retest → Drop

4. Sell Setup

Your setup shows:

- Entry: Near the support retest.

- Stop Loss: Above the descending trendline and recent swing highs.

- Take Profit: Much lower, aligning with the next major support zone (~around 3928 area).

Risk-reward looks favorable (around 1:3 or more).

Summary (in simple English)

Your chart is showing a bearish trend.

Price is rejecting the descending trendline and is sitting on a strong support.

If this support breaks, price is expected to retest it and continue falling, which matches your sell setup.

Your sell idea is logical based on:

- Trendline rejection

- Bearish market structure

- Break-and-retest pattern