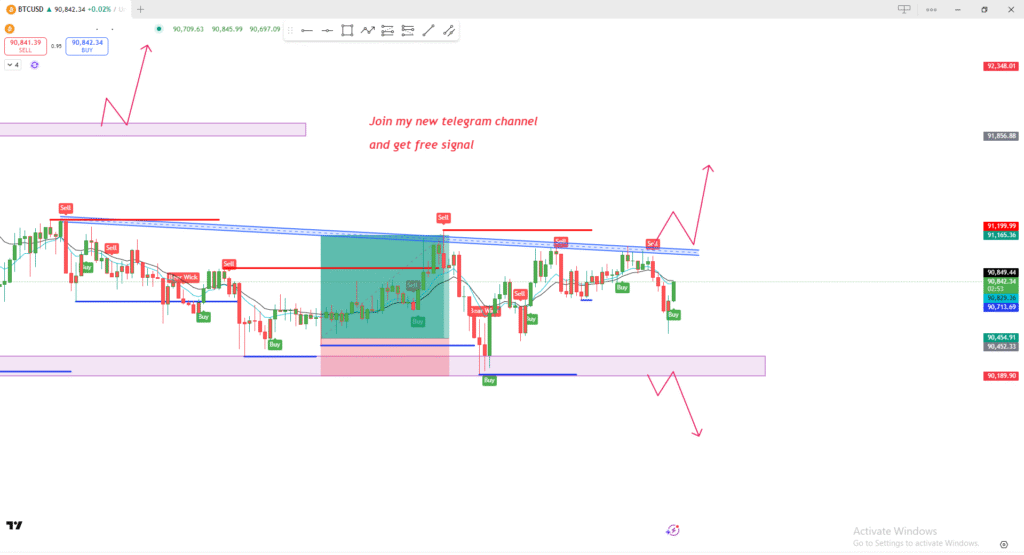

Technical Analysis of the Chart

1. Overall Structure

- This is a BTC/USD intraday chart with several marked zones:

- Upper resistance zone around 91,150 – 91,200

- Lower demand/support zone around 90,450 – 90,190

- A descending trendline (blue) connects multiple highs, showing earlier bearish pressure.

2. Key Observations

A. Resistance Zone

- Price has repeatedly reacted around the 91,150 – 91,200 zone.

- Several Sell labels are placed at this zone, showing that sellers were active here.

- The chart shows a potential breakout scenario if price breaks above this trendline and re-tests it successfully.

B. Support Zone

- The purple support block at the bottom shows where price reversed upward multiple times.

- The “Buy” labels near this area indicate bullish reaction from this demand zone.

C. Trendline Behavior

- The blue descending trendline was tested several times.

- Recently, price seems to be pressing against the trendline, suggesting weakening bearish momentum.

3. Possible Scenarios (as drawn on the chart)

Bullish Scenario

- Price breaks above the blue trendline and the red resistance line.

- Then pulls back to retest the breakout area.

- If the retest holds, price may move higher toward the next resistance zone.

Bearish Scenario

- Price fails to break the trendline.

- It falls back into the large purple support block.

- If that zone breaks, a deeper drop toward lower levels is suggested.

4. Price Action Structure

- The market is currently ranging between:

- Upper resistance: ~91,150–91,200

- Lower support: ~90,450–90,190

- Multiple small “Buy” and “Sell” labels show short-term scalping entries.

5. Summary

The chart shows:

- A range market with clear support and resistance.

- Market is currently near trendline resistance.

- A breakout could lead to bullish continuation.

- A rejection could bring price back to the support block.