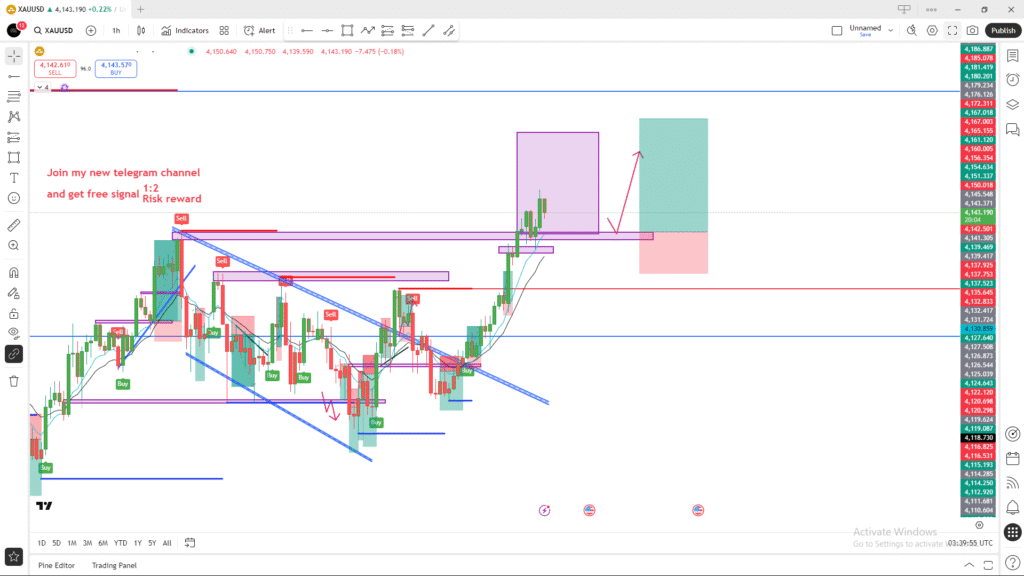

📊 Chart Analysis (XAUUSD – 1H)

1. Market Structure

- The overall trend in the visible area is bullish.

- Price has recently broken above a resistance zone (marked in purple).

- After the breakout, price is now pulling back toward the same zone, which may act as new support (R → S flip).

2. Key Levels

Support Zone (Pullback Area)

- The purple horizontal area just below the current price is the expected retest zone.

- If price stays above this zone, buyers remain in control.

Resistance Zone / Target Area

- The big green box at the top marks the take-profit zone.

- This represents the projected bullish continuation.

3. Expected Price Action

According to the red arrow drawn on the chart:

- Price may retest the support zone (purple box).

- If a bullish reaction appears (rejection wick, bullish engulfing, etc.),

- The market may continue pushing upward toward the green target zone.

4. Trade Setup Shown

Entry

- Expected around the support retest area.

Stop-Loss

- SL marked inside the red box below the support.

- This protects the trade if price breaks down.

Take-Profit

- TP marked inside the green box.

- Risk-to-reward ratio indicated as 1:2.

5. Summary

- The chart suggests a bullish trend continuation setup.

- Price is expected to retest previous resistance → turn into support.

- A long (buy) entry is planned after confirmation.

- SL below support, TP at the next resistance swings.